Most people think flexible packaging wins because it’s cheaper. That’s only half the story. I’ve watched companies lose millions when rigid containers cracked during cold storage. The flexible pouches? They leaked sometimes, but that’s a customer complaint, not a legal disaster.

Flexible packaging outperforms rigid packaging in supply chain resilience1 and total cost of failure, not just unit price. Smart operators track "failure cost per million units shipped2" and choose flexible at high-risk touchpoints where products face temperature changes3, drops, or rough handling. Rigid packaging still dominates where stacking strength and premium shelf presence justify the higher liability risk.

Here’s what most procurement teams get wrong: they optimize for the purchase price per unit. They ignore what happens when that glass jar shatters in a delivery truck or when a plastic bottle cracks in freezing weather. The companies that survived multiple recessions? They mapped every point where packaging touched human hands or machinery. Then they made their choice.

What Is Flexible Packaging and Why Does It Fail Better?

Flexible packaging4 bends instead of breaks. That’s the simple truth nobody emphasizes enough.

Flexible packaging includes stand-up pouches, flat bags, side gusset bags, and ziplock pouches made from multilayer films5. These structures use materials like polyethylene, polypropylene, or compostable films that flex under pressure instead of shattering. When flexible packaging fails, it typically leaks rather than explodes, which contains the damage and reduces contamination risk.

I’ve seen this pattern repeat across industries. A frozen food company switched from rigid plastic trays to flexible pouches for their ready meals. During one harsh winter, their old rigid packaging would crack during transport. Entire pallets became unsellable. The flexible pouches? Some developed small leaks, but the product stayed mostly intact. The financial difference was huge.

The Hidden Cost of Rigidity’s Brittleness

Rigid packaging6 offers excellent stacking strength and premium appearance. Glass bottles signal quality. Metal cans protect against light and oxygen better than most flexible structures. Cardboard boxes stack perfectly on pallets. But rigid materials have a fatal flaw: they fail catastrophically.

When a glass jar breaks, you lose the entire product. When a metal can dents badly, it might contaminate the contents. When a plastic bottle cracks, the liquid spills everywhere. Each failure creates multiple costs: product loss7, cleanup, potential recalls, and liability claims8.

I once spoke with a logistics manager who described losing an entire container of sauce bottles due to poor stacking during transport. One incident cost them tens of thousands in product loss and cleanup alone.

Flexible packaging fails differently. A small puncture might let air in slowly. A seal might weaken and leak. But the failure is gradual, not instant. This matters enormously in supply chain management. You can often catch and remove damaged flexible packages before they reach customers. With rigid packaging, the damage is immediate and total.

Material Science and Barrier Properties

People assume rigid packaging always offers better protection. This was true twenty years ago. Modern flexible packaging has closed the gap dramatically.

Today’s multilayer flexible films combine different materials in one structure. You might have an outer layer for printing and abrasion resistance, a middle barrier layer blocking oxygen and moisture, and an inner sealant layer for product contact. This creates protection comparable to rigid containers for many applications.

Consider coffee packaging. Traditional metal cans provided excellent barrier properties9. Modern flexible coffee bags use metalized films that block light, oxygen, and moisture just as effectively. The flexible bag weighs 90% less than the metal can. It ships more efficiently. It takes up less landfill space. And when it fails, it doesn’t create sharp metal edges.

What Is Rigid Packaging and Where Does It Excel?

Rigid packaging cannot bend or compress easily. This creates both advantages and limitations.

Rigid packaging includes glass bottles, metal cans, plastic containers, and cardboard boxes that maintain their shape under normal handling. These structures excel at protecting fragile contents10, providing premium shelf presence11, and offering superior stacking strength12 for warehouse storage. Industries use rigid packaging when product protection during distribution outweighs the higher material and shipping costs.

I won’t pretend flexible packaging works for everything. Certain products genuinely need rigid containers. Carbonated beverages require pressure-resistant bottles or cans. Aerosol products need metal containers by regulation. Premium spirits brands rely on glass bottles for brand positioning. These are legitimate uses where rigid packaging remains the best choice.

When Rigid Packaging Makes Economic Sense

Rigid packaging justifies its higher cost in specific situations. If your product is extremely fragile and high-value, the extra protection matters more than shipping costs. If your brand positioning requires glass or metal for consumer perception, the premium price might be worth it.

The calculation changes based on your distribution model. Companies shipping products short distances with minimal handling can use lighter, less protective packaging. Brands shipping globally through multiple distribution centers need maximum protection. Rigid packaging often wins in complex supply chains with many touchpoints.

The Stacking Strength Advantage

Warehouses and retailers stack products on pallets and shelves. Rigid packaging handles this better than most flexible formats. A cardboard box maintains its shape under weight. Plastic bottles stack securely. Metal cans create stable pallet loads.

Flexible packaging requires different thinking. Stand-up pouches need shelf support. Flat bags don’t stack well without secondary packaging. This isn’t necessarily a disadvantage, but it requires planning. Many brands combine flexible primary packaging with rigid secondary packaging. Coffee in a flexible pouch ships inside a cardboard box. Sauce in a flexible pouch comes in a display-ready case.

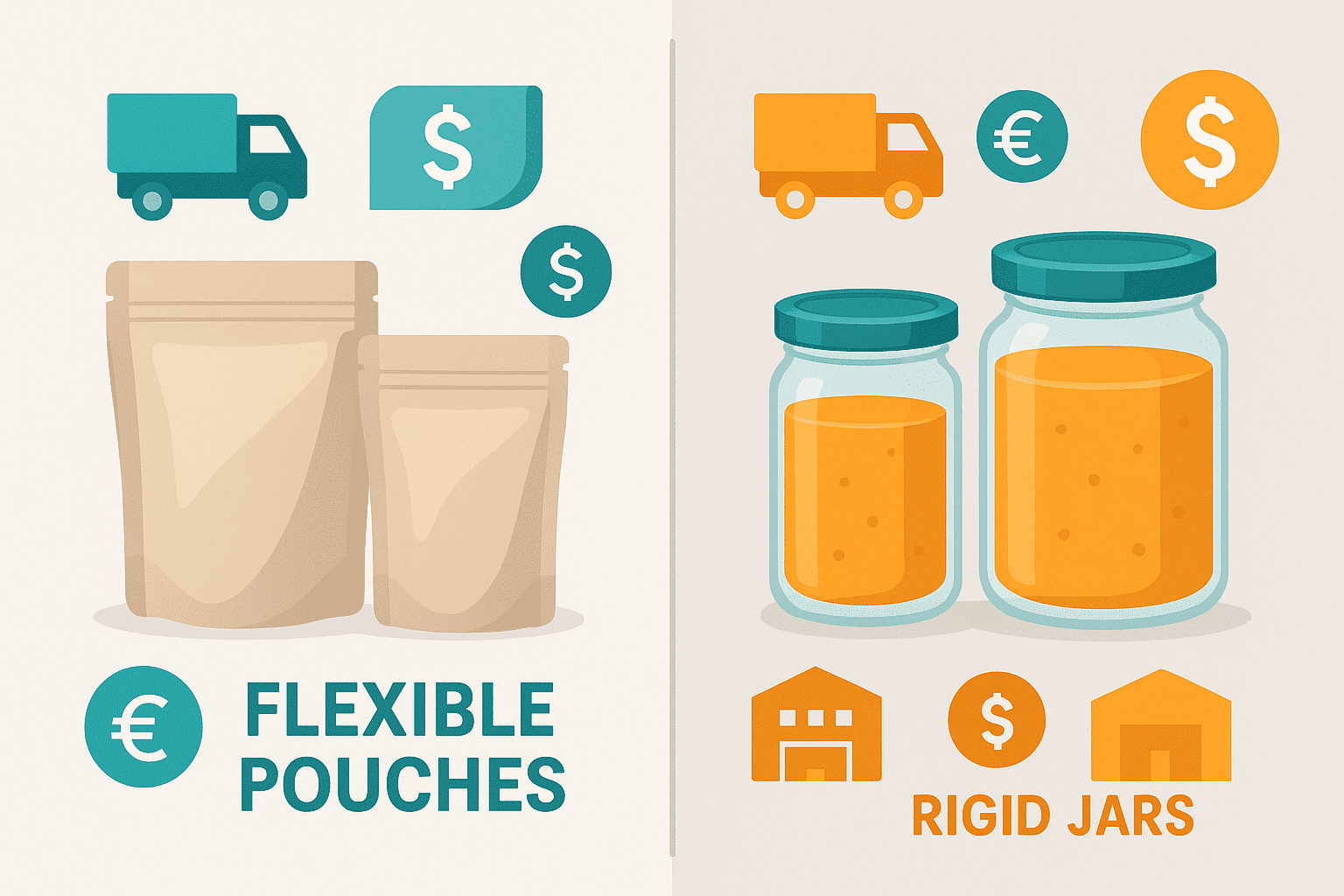

Flexible vs Rigid Packaging: The Real Cost Comparison

Unit price tells you almost nothing about true packaging cost. I’ve seen this mistake cost companies millions.

Total packaging cost includes material cost, shipping weight13, storage space, failure rates, and disposal fees14. Flexible packaging typically costs 30-60% less than rigid packaging when calculating total delivered cost. The weight difference drives most savings: flexible pouches weigh 85-95% less than equivalent rigid containers, reducing freight costs and carbon emissions proportionally.

Here’s a real example from the food industry. A sauce manufacturer used glass jars for years. Each jar weighed 200 grams empty. They switched to flexible stand-up pouches weighing 20 grams. Same product capacity. The material cost stayed roughly similar. But shipping costs dropped 40% immediately. Warehouse space requirements decreased 60%. Breakage during shipping fell from 3% to 0.2%.

Calculating Failure Cost Per Million Units

This metric changed how I evaluate packaging options. Most companies don’t track it systematically.

Take your total annual units shipped. Count every product loss7 from packaging failure: breakage, leaks, contamination, recalls. Add the direct product cost, cleanup costs, and any customer compensation. Divide by total units and multiply by one million. This gives you failure cost per million units shipped2.

For rigid packaging in challenging distribution environments, I’ve seen this number reach $50,000 to $200,000 per million units. For flexible packaging in the same conditions, it typically runs $5,000 to $20,000. That ten-fold difference dwarfs any unit price savings from choosing cheaper rigid containers.

Hidden Costs of Rigid Packaging

Storage space costs money. Rigid packaging occupies 3-5 times more warehouse volume than equivalent flexible packaging. In urban areas with expensive warehouse space, this matters significantly.

Disposal costs keep rising. Many municipalities charge by weight or volume for commercial waste. Rigid packaging creates more of both. Glass is heavy. Cardboard boxes are bulky. Plastic bottles take up space even when crushed.

Labor costs add up too. Rigid containers take longer to unpack, stock, and handle. They require more careful handling to prevent breakage. Workers need more time to deal with damaged rigid packaging when it occurs.

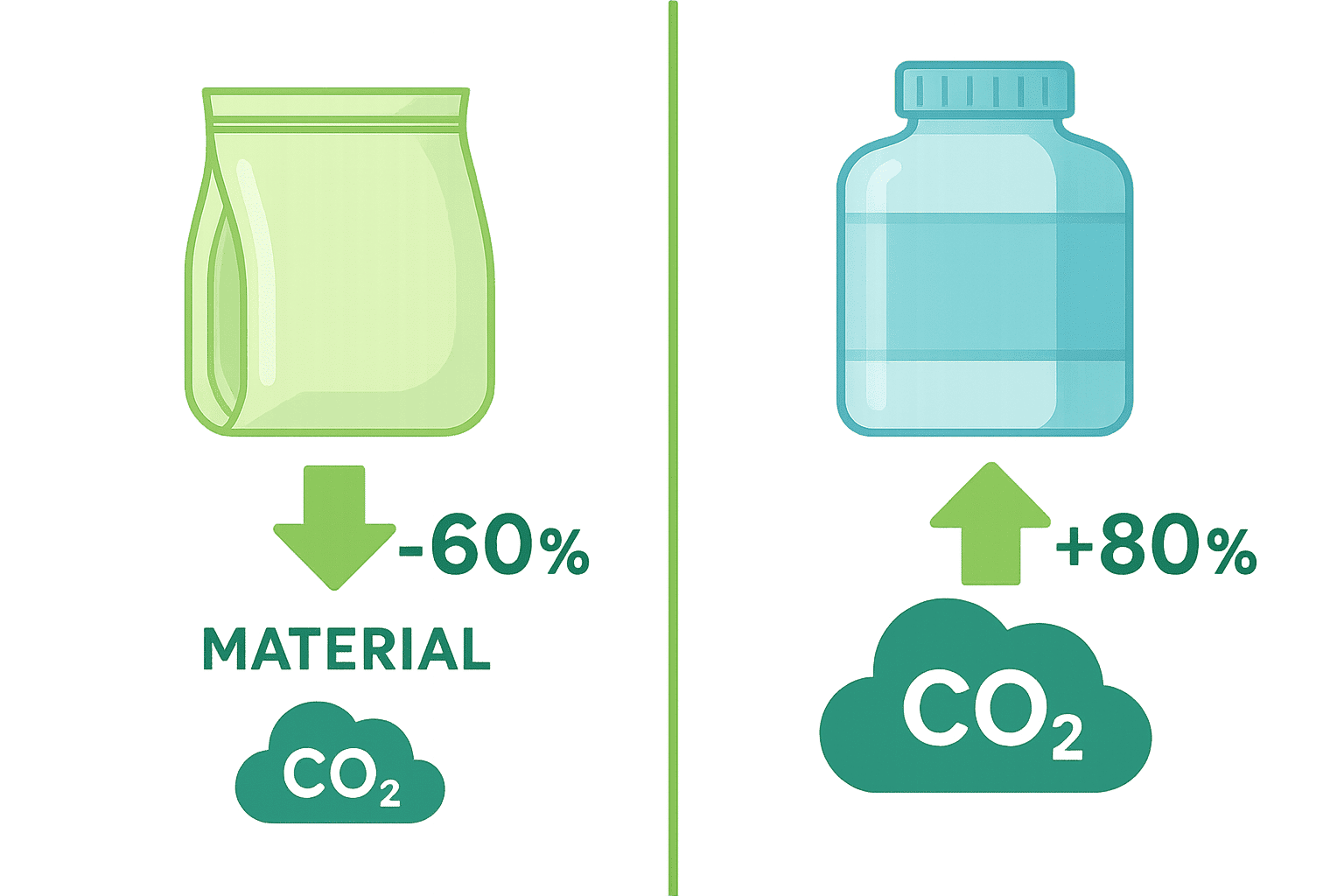

Environmental Impact: Beyond Simple Recycling

Everyone wants to talk about recycling rates. That’s important, but it’s not the whole story.

Flexible packaging reduces environmental impact through source reduction, lower transportation emissions, and decreased landfill volume, even when recycling rates lag behind rigid packaging. A flexible pouch uses 70-90% less material than an equivalent rigid container, requires 60% less energy to manufacture, and generates 50-70% fewer carbon emissions during transportation.

I’m not going to claim flexible packaging is perfect environmentally. Recycling infrastructure for multilayer flexible films lags behind glass, metal, and rigid plastic recycling. This is a real limitation. But the analysis can’t stop there.

Source Reduction Matters More Than Recycling

Using less material in the first place beats recycling every time. A flexible pouch for laundry detergent uses 15 grams of material. A plastic bottle for the same amount uses 45 grams. Even if the bottle gets recycled and the pouch doesn’t, the pouch still wins on total environmental impact.

Transportation emissions dwarf manufacturing emissions for most products. Lighter packaging means lower fuel consumption and fewer carbon emissions across the entire supply chain. When you ship products globally, this difference becomes massive.

The Compostable Packaging Revolution

Material science keeps advancing. I’ve watched compostable flexible packaging transform from a niche curiosity to a mainstream option over the past five years.

Modern compostable films can match conventional plastic performance for many applications. They provide good barrier properties, print beautifully, and seal reliably. They cost more currently, but prices keep dropping as production scales up.

For my business, I recommend compostable flexible packaging solutions because that’s what I can deliver. Stand-up pouches, flat bottom bags, and side gusset bags made from compostable materials work beautifully for coffee, snacks, pet food, and many cosmetics. Last year, a specialty coffee roaster switched their entire product line to our compostable pouches. Within months, their customers reported significantly higher satisfaction, and waste audits showed their packaging breaking down completely within ninety days in commercial composting facilities.

Industry-Specific Applications: Where Each Type Wins

Different industries have different priorities. Understanding these helps clarify when to choose flexible versus rigid.

Food and beverage industries increasingly prefer flexible packaging for dry goods, frozen foods, and liquid products that don’t require pressure resistance. Rigid packaging dominates carbonated beverages, premium alcohol, and products requiring extended shelf life without refrigeration. Pet food, cosmetics, and health supplements show the fastest shift from rigid to flexible formats.

The pet food industry demonstrates this transition clearly. Five years ago, most pet food came in rigid plastic containers or metal cans. Today, flexible stand-up pouches dominate wet pet food, and many dry pet food brands have switched to flexible bags. The reasons are purely practical: lower costs, better shelf presence, and easier handling for consumers.

Food Industry Trends

Frozen foods are moving to flexible packaging rapidly. The old rigid plastic trays are giving way to flexible pouches that take up less freezer space and protect products better against freezer burn.

Sauces and condiments show mixed results. Ketchup and mayo brands experiment with flexible squeeze pouches, but many consumers still prefer the familiar rigid bottles. Consumer acceptance takes time. Smart brands offer both options and let the market decide.

Snack foods have always favored flexible packaging. Chips, cookies, and crackers need protection from crushing and moisture, but they don’t need rigid containers. Flexible bags provide perfect protection at minimal cost.

Cosmetics and Personal Care

This industry values premium appearance highly. Glass bottles and rigid plastic jars signal quality and justify higher prices. But even here, flexible packaging gains ground.

Face masks moved almost entirely to flexible pouches. They’re single-use products where convenience matters more than premium appearance. Hand cream, body lotion, and shampoo increasingly offer refill options in flexible pouches. Consumers buy the rigid dispenser once, then refill with cheaper flexible pouches.

For my clients in cosmetics, I recommend flexible pouches for samples, travel sizes, and refills. The full-size primary product might stay in rigid packaging for brand positioning, but flexible packaging handles many secondary applications perfectly.

Health Supplements and Nutraceuticals

Protein powders traditionally came in large plastic tubs. These rigid containers took up enormous shelf space and cost a lot to ship. Flexible stand-up pouches have captured significant market share because they solve both problems.

Single-serve supplement sachets use flexible packaging exclusively. Nobody needs a rigid container for a one-time use product. The flexible sachet protects the contents perfectly and costs almost nothing.

Vitamin bottles remain mostly rigid, but this might change. Child-resistant flexible pouches now meet safety requirements. If brands can maintain product stability in flexible packaging, the cost savings will drive adoption.

Consumer Preferences and Convenience Features

What consumers say they want and what they actually buy often differ. I’ve learned to watch purchasing behavior more than survey responses.

Consumers prefer packaging that offers easy opening, resealability, portability, and clear product visibility. Flexible packaging excels at incorporating convenience features like tear notches, zip locks, and transparent windows. Rigid packaging offers superior stability for pouring and serving but requires more storage space and creates more disposal hassle.

The resealability advantage of flexible packaging matters more than most brands realize. A stand-up pouch with a ziplock keeps products fresh after opening and eliminates the need for separate storage containers. Consumers appreciate this convenience even if they don’t articulate it clearly.

The Portability Factor

Flexible packaging wins decisively on portability. Parents packing school lunches prefer juice pouches over glass bottles. Hikers choose flexible nut butter packets over glass jars. Travelers pack toiletries in flexible tubes, not rigid bottles.

This portability extends beyond consumer convenience. Retailers value packaging that reduces shipping damage and shelf space requirements. Flexible packaging delivers both benefits automatically.

Opening and Dispensing Experience

Rigid packaging traditionally offered better dispensing control. Bottles pour predictably. Jars allow easy access with spoons. But flexible packaging has improved dramatically.

Spout pouches now compete directly with bottles for liquids. The spout provides controlled dispensing while the flexible body reduces waste by allowing consumers to squeeze out the last drops. Many people find this superior to rigid bottles where product sticks to the bottom.

For thick products like nut butters or sauces, the squeeze-and-roll approach works brilliantly. You can’t do this with a rigid jar. Some consumers resist the change initially, but most prefer it once they try it.

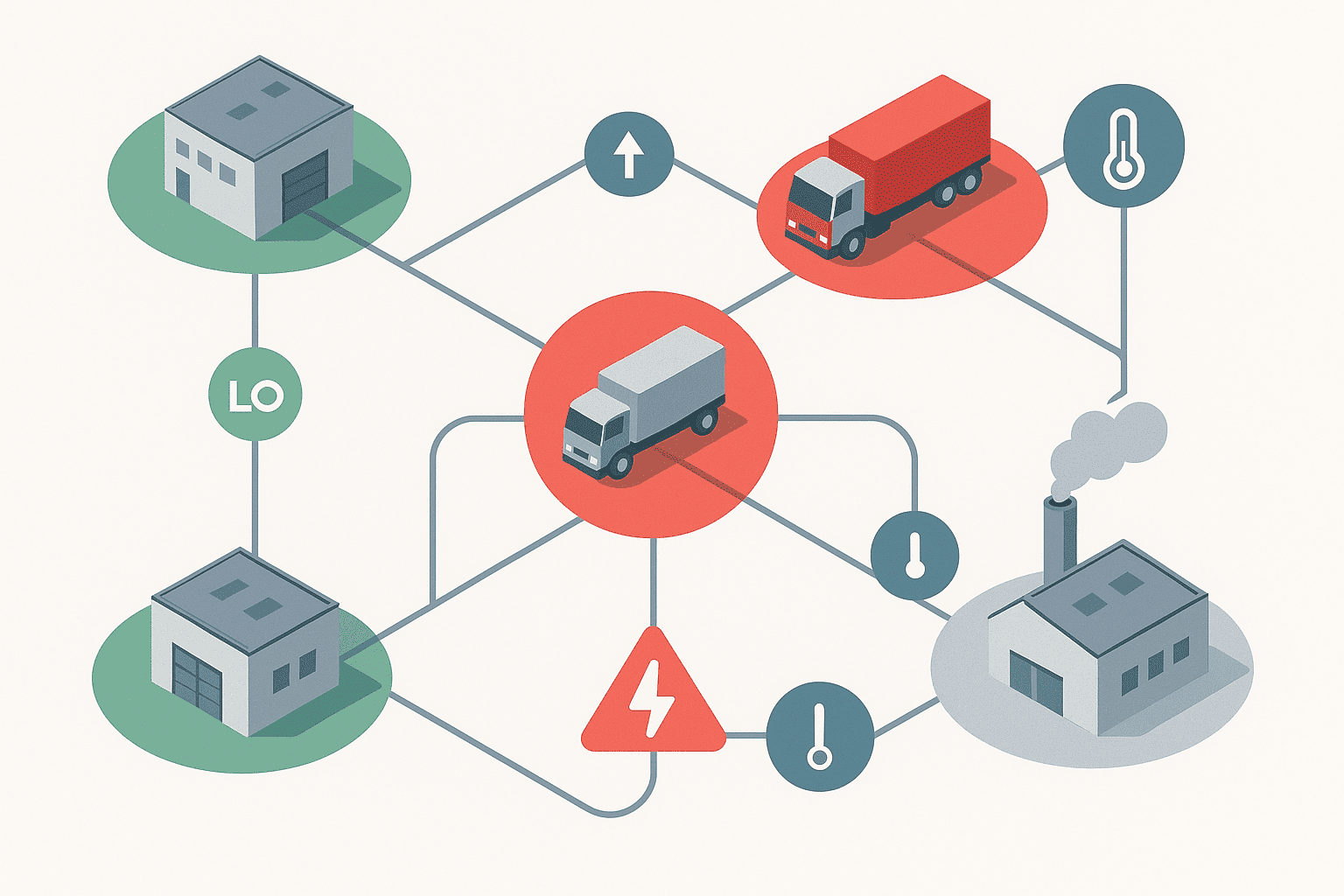

The High-Risk Touchpoint Strategy

This is where smart operators separate themselves from average procurement teams.

Map every point in your supply chain where packaging experiences stress: temperature changes, drops, compression, or rough handling. Choose flexible packaging at high-risk nodes where failure probability exceeds 2%, and reserve rigid packaging for low-risk segments where stacking strength or premium presentation justifies the additional cost.

I recommend this analysis to every client. Start at manufacturing. How does packaging get filled and sealed? What stress does this create? Then follow the product through warehousing, shipping, retail distribution, and final consumer handling. Identify every potential failure point.

Temperature Stress Points

Temperature changes destroy more rigid packaging than people realize. Glass and rigid plastic expand and contract at different rates than their contents. Rapid temperature changes create stress fractures. I’ve seen entire shipments of glass jars crack when moved from a hot warehouse into a refrigerated truck.

Flexible packaging handles temperature stress better. The material flexes to accommodate expansion and contraction. Freezer burn in frozen foods usually results from seal failure, not material failure, and modern flexible packaging sealing technology has improved dramatically.

Mechanical Stress Analysis

Drops and impacts happen throughout the supply chain. Warehouse workers drop boxes. Delivery trucks hit potholes. Consumers knock products off shelves. Each event creates mechanical stress.

Rigid packaging fails catastrophically under impact. The container cracks or shatters, destroying the product immediately. Flexible packaging absorbs impact through deformation. The pouch might develop a small leak eventually, but it survives most drops intact.

The Premium Segment Paradox

Watch for this trend. It signals a major shift in consumer psychology and material science capabilities.

Premium brands are switching from rigid to flexible packaging in categories where this was previously unthinkable. This indicates that material science has solved the last significant barriers to flexible packaging adoption in high-value segments. When you see premium coffee in pouches, premium pet food in bags, or premium skincare in tubes instead of jars, that’s your three-year warning that the mass market will follow.

Luxury brands don’t make packaging changes lightly. Their brand equity depends on maintaining premium perception. When they switch to flexible packaging, it means they’ve confirmed that consumers accept or even prefer the change.

Coffee Industry Example

Specialty coffee led this transition. Premium roasters used to favor rigid metal tins or glass jars to signal quality. High-end coffee now overwhelmingly uses flexible stand-up pouches with one-way degassing valves.

The flexible pouch actually protects coffee better than rigid containers. The valve allows CO2 to escape without letting oxygen in. The multilayer film blocks light and moisture completely. And consumers can squeeze out all the air before resealing, extending freshness better than any rigid container.

For my packaging business, premium coffee represents my largest and fastest-growing segment. I provide stand-up pouches with degassing valves, metallized films for light protection, and beautiful print graphics that communicate quality effectively. One premium roaster increased their market share by thirty percent after switching to our pouches, proving that quality-conscious consumers valued the superior freshness and sustainability over traditional tin packaging aesthetics.

Pet Food Premium Segment

Premium wet pet food used to mean metal cans exclusively. The can signaled quality and preservation. But veterinarians started recommending flexible pouches because they’re easier for pets to digest completely. Pet owners appreciated the lighter weight and easier disposal.

Now premium pet food brands use flexible pouches as much as budget brands. The differentiation comes from material quality, print graphics, and product formulation, not packaging structure.

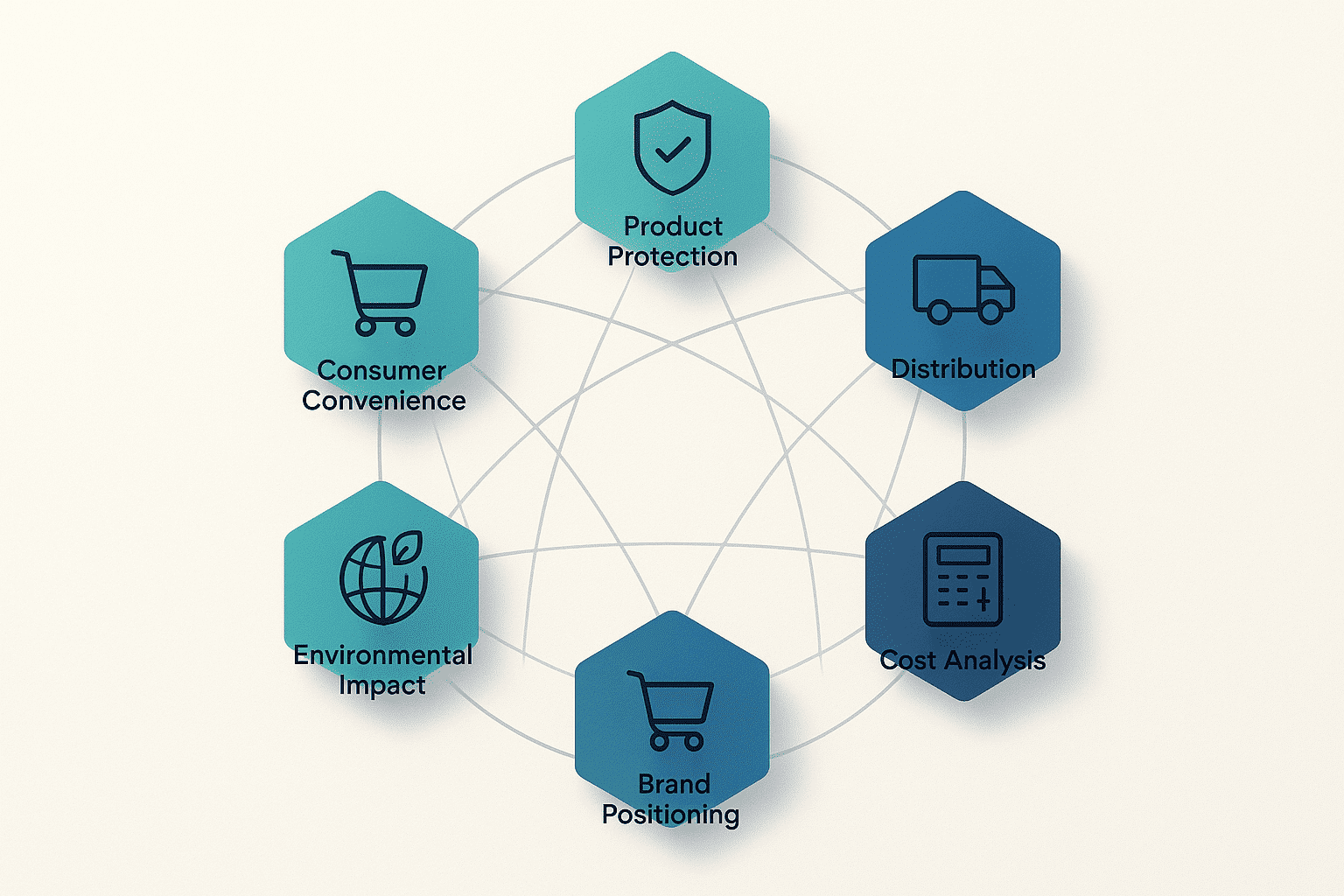

Making Your Decision: A Practical Framework

You need a systematic approach to choose between flexible and rigid packaging. Emotions and habits make bad advisors.

Evaluate packaging choices using six criteria: product protection requirements, distribution environment stress levels, brand positioning needs, total delivered cost, environmental impact targets, and consumer convenience priorities. Weight each factor based on your specific business model and competitive position. Choose flexible packaging when protection, cost, and sustainability matter most. Choose rigid when premium positioning, pressure resistance, or extreme stacking strength justify the higher total cost.

I walk through this framework with every potential client. Some products genuinely need rigid packaging. Many more default to rigid packaging because "that’s how we’ve always done it." The framework forces objective analysis instead of habit-driven decisions.

Product Protection Requirements

Start here. What actually happens if packaging fails? For carbonated beverages, failure means explosion and total product loss. You need rigid pressure-resistant containers. For dry snacks, failure means staleness and potential crushing. Flexible bags handle this perfectly.

Don’t overestimate protection needs. Many products use rigid packaging for protection they don’t actually require. I’ve seen dry goods in rigid plastic containers when a simple flexible pouch would work fine. The excess protection costs money without adding value.

Distribution Environment Analysis

How does your product move from factory to consumer? Direct-to-consumer shipping faces different stresses than retail distribution. International shipping creates different challenges than domestic distribution.

For complex distribution with many touchpoints, I recommend flexible packaging at primary product level with rigid secondary packaging for shipping. This combines protection with efficiency. The flexible primary package protects the product. The rigid outer case protects the flexible packages during rough handling.

Brand Positioning Considerations

Be honest about whether your brand actually needs premium rigid packaging or just thinks it does. Consumer perception studies often show that great graphics and quality materials matter more than rigid versus flexible structure.

Some categories maintain strong associations between rigid packaging and quality. Others have already shifted. Research your specific category carefully. Don’t assume based on past conventions.

Frequently Asked Questions About Flexible vs Rigid Packaging

1. Is flexible packaging really more sustainable than rigid packaging?

Flexible packaging creates 60-70% lower carbon emissions and uses 70-90% less material than equivalent rigid packaging, but recycling infrastructure currently favors rigid materials. Total environmental impact depends on whether you prioritize source reduction or end-of-life recycling. For most applications, the massive reduction in material use and transportation emissions outweighs the recycling disadvantage.

2. Can flexible packaging protect products as well as rigid packaging?

Modern multilayer flexible films provide barrier protection equivalent to rigid packaging for most applications. Flexible packaging excels at protecting against moisture, oxygen, and light. It handles impacts better through deformation rather than shattering. Flexible packaging cannot match rigid packaging for products requiring pressure resistance or extreme stacking strength.

3. Why do some premium brands still use rigid packaging?

Premium brands use rigid packaging for three main reasons: consumer perception that rigid equals quality in certain categories, genuine product requirements like carbonation or pressure, and retail shelf presentation advantages. However, premium brands increasingly adopt flexible packaging as material science improves and consumer attitudes evolve.

4. How much can I save by switching from rigid to flexible packaging?

Total delivered cost typically decreases 30-60% when switching from rigid to flexible packaging. Savings come from lower material costs, reduced shipping weight, decreased storage space requirements, and lower failure rates. The exact savings depend on your distribution model, shipping distances, and product characteristics.

5. What products should never use flexible packaging?

Carbonated beverages, aerosol products, and items requiring extreme stacking strength (over 50 kg per layer) should remain in rigid packaging. Products where consumer perception strongly associates rigid packaging with quality might also resist switching, though this barrier erodes over time as flexible packaging quality improves.

Conclusion

The flexible versus rigid packaging debate isn’t about declaring a universal winner. It’s about matching packaging structure to product needs, distribution environment, and business priorities. Flexible packaging wins on cost, sustainability, and failure resilience for most applications. Rigid packaging remains superior for pressure resistance and premium positioning in specific categories. Smart operators map their supply chain touchpoints, calculate true failure costs, and choose the right packaging structure for each unique situation rather than following industry conventions blindly.

-

Understand the importance of supply chain resilience and how it influences packaging decisions. ↩

-

Discover how tracking failure costs can lead to better packaging choices and significant savings. ↩ ↩

-

Find out how temperature fluctuations impact packaging integrity and product safety. ↩

-

Explore the advantages of flexible packaging, including cost savings and resilience in supply chains. ↩

-

Understand the technology behind multilayer films and their advantages in flexible packaging. ↩

-

Learn about the strengths of rigid packaging, especially in terms of product protection and shelf presence. ↩

-

Explore the various factors contributing to product loss and how to mitigate them. ↩ ↩

-

Explore the potential financial implications of liability claims due to packaging failures. ↩

-

Discover the significance of barrier properties in protecting products from external factors. ↩

-

Discover the best packaging solutions for protecting fragile products during transport. ↩

-

Explore how packaging design influences consumer perception and brand positioning. ↩

-

Learn about stacking strength and its role in efficient storage and transportation. ↩

-

Explore the impact of shipping weight on overall packaging expenses and logistics. ↩

-

Understand the rising costs of disposal and how packaging choice affects waste management. ↩